Missouri Tax Calculator

Missouri Income Tax Calculator - SmartAsset

The federal income tax deduction allows Missouri taxpayers to deduct federal income taxes paid, up to a limit of $5,000 for single filers and $10,000 for joint filers for tax year 2021. In addition to the state tax, St. Louis and Kansas City both collect their own earning taxes of 1%.

https://smartasset.com/taxes/missouri-tax-calculator

Tax Calculators - Missouri

Tax Calculators. Home » Calculators. Use our handy calculators linked below to assist you in determining your income tax, withholding, or penalties for failure to file or pay taxes. Additions to Tax and Interest Calculator. Income Tax Calculator. Sales/Use Tax Bond Calculator. Withholding Calculator.

https://dor.mo.gov/calculators/

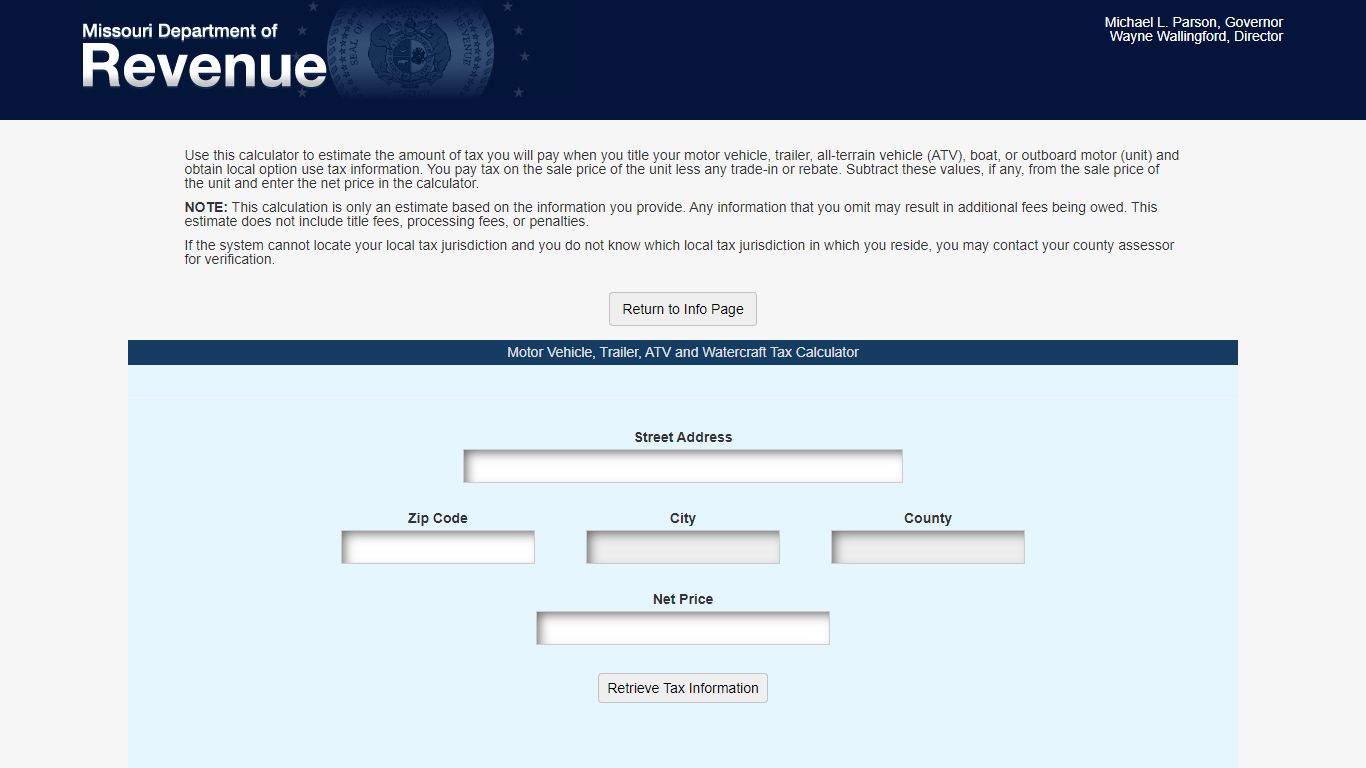

Tax Calculator - Missouri

Tax Calculator. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle, trailer, all-terrain vehicle (ATV), boat, or outboard motor (unit) and obtain local option use tax information. You pay tax on the sale price of the unit less any trade-in or rebate. Subtract these values, if any, from the sale ...

https://sa.dor.mo.gov/mv/stc/

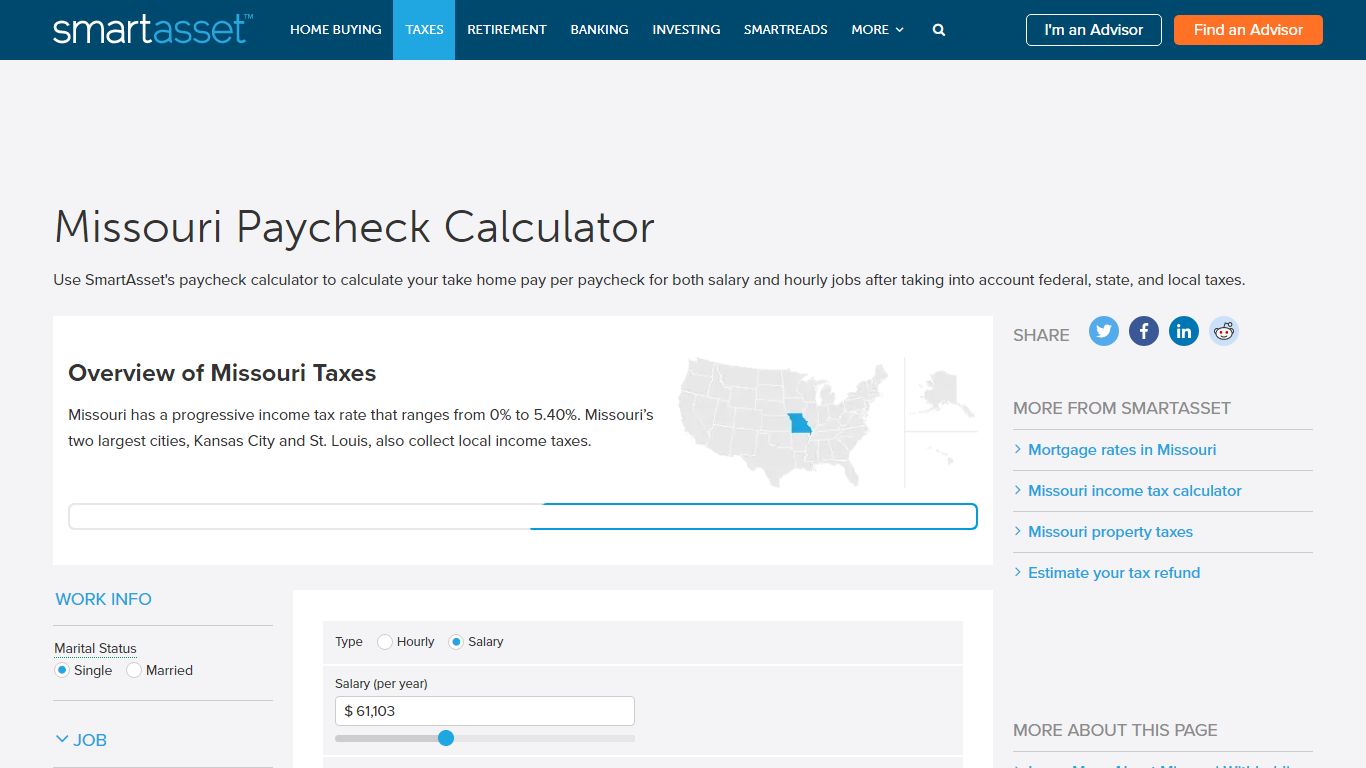

Missouri Paycheck Calculator - SmartAsset

Use SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Overview of Missouri Taxes Missouri has a progressive income tax rate that ranges from 0% to 5.40%.

https://smartasset.com/taxes/missouri-paycheck-calculator

Missouri Tax Calculator: Estimate Your Taxes - Forbes Advisor

Missouri Income Tax Calculator 2021. If you make $70,000 a year living in the region of Missouri, USA, you will be taxed $11,490. Your average tax rate is 11.98% and your marginal tax rate is 22% ...

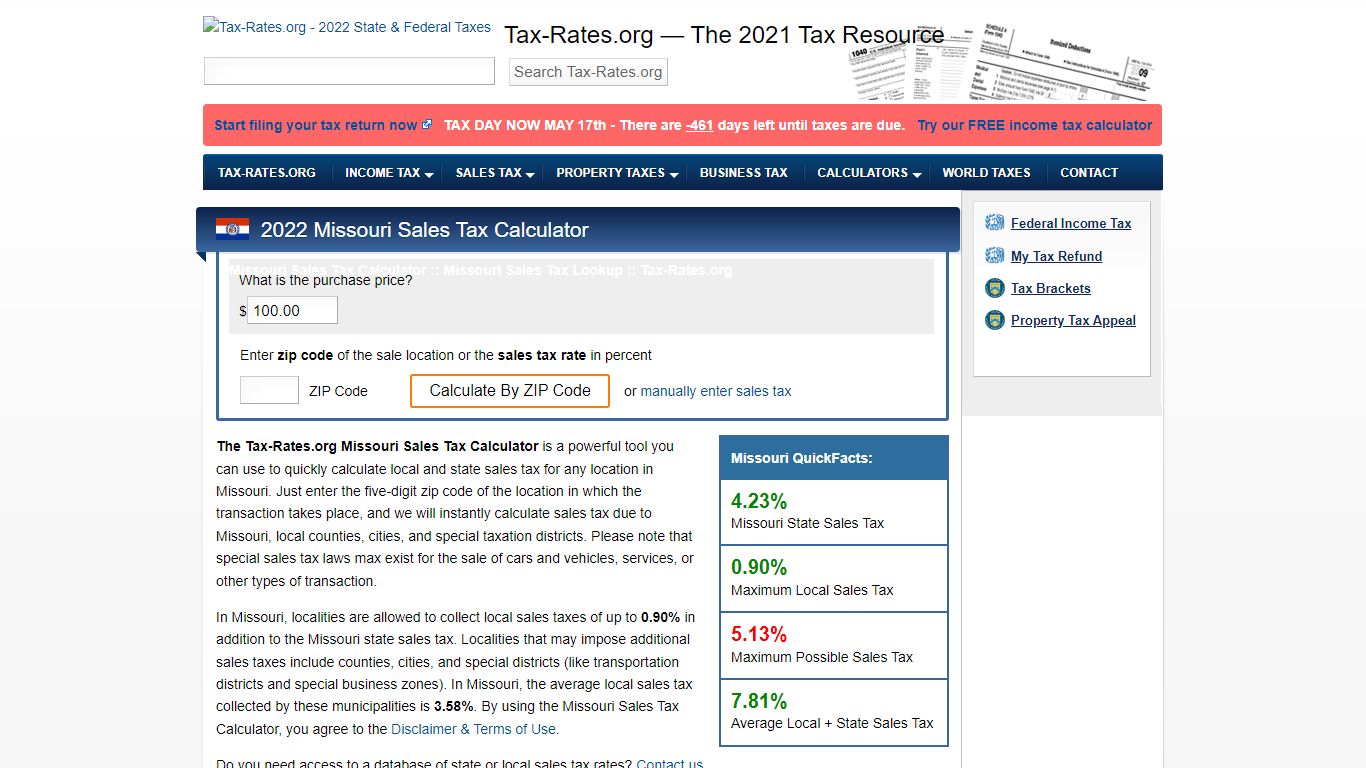

https://www.forbes.com/advisor/income-tax-calculator/missouri/Missouri Sales Tax Calculator - Tax-Rates.org

The Tax-Rates.org Missouri Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Missouri. Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Missouri, local counties, cities, and special ...

https://www.tax-rates.org/missouri/sales-tax-calculator

Individual Income Tax Calculator - Missouri

Individual Income Tax Calculator. Double check your tax calculation! Enter the taxable income from your tax form and we will calculate your tax for you. Line references from each Missouri tax form are provided below. If you haven't started your Missouri income tax return and you would like help calculating the entire tax return, you may ...

https://mytax.mo.gov/rptp/portal/home/indiv-income-tax-calculator/!ut/p/z1/jc_BCoJAEAbgZ-ng1RnUUrotHRQRNgvT5hJKthrqyrr5_IkFXUqa08zwzQ8DBBlQl4-1yHUtu7yZ5jNtLnzvsGDnI-eBixjHB9tzI8tCREhngD-KIdA_9wuAluNToJnYHu78AK3QT44WMs4S58TCqXPeYCEjBBKNLF7vsq6wPQGkylupSmU-1LSutO6HrYEGXqUyW2kKORr4jVdy0JB9FPRtkuF93YwRWz0BUuKRiQ!!/dz/d5/L2dBISEvZ0FBIS9nQSEh/

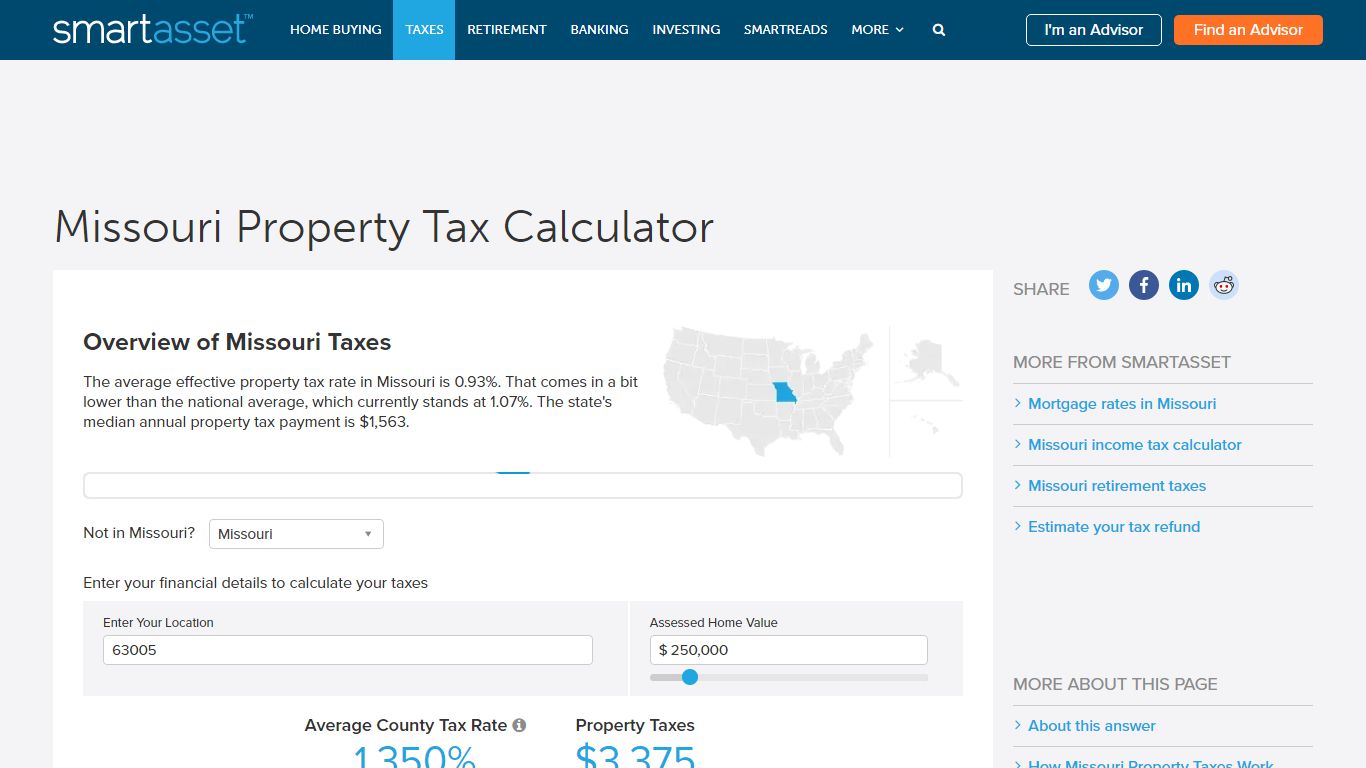

Missouri Property Tax Calculator - SmartAsset

That means that assessed value should equal to 19% of market value. For example, if your home is worth $200,000, your assessed value will be $38,000. Your total tax rate applies to that $38,000. Missouri Property Tax Rates. Tax rates in Missouri are set by a variety of local tax authorities.

https://smartasset.com/taxes/missouri-property-tax-calculator

Property Tax Calculators - Missouri

Property Tax Calculators. State law requires the Missouri State Auditor to annually review all property tax rates throughout Missouri as to their compliance with the state law. Please contact the State Auditor’s Tax Rate Section if you have any questions regarding the calculation of property taxes at 573-751-4213.

https://auditor.mo.gov/property-tax-calculators

Motor Vehicle, Trailer, ATV and Watercraft Tax Calculator - Missouri

Home » Motor Vehicle » Sales Tax Calculator. The Department collects taxes when an applicant applies for title on a motor vehicle, trailer, all-terrain vehicle, boat, or outboard motor (unit), regardless of the purchase date. For additional information click on the links below: Motor vehicle titling and registration.

https://dor.mo.gov/motor-vehicle/sales-tax-calculator.html

Missouri State Tax Calculator - Good Calculators

Missouri Salary Tax Calculator for the Tax Year 2022/23 You are able to use our Missouri State Tax Calculator to calculate your total tax costs in the tax year 2022/23. Our calculator has recently been updated to include both the latest Federal Tax Rates, along with the latest State Tax Rates.

https://goodcalculators.com/us-salary-tax-calculator/missouri/